Table of Content

A passport that doesn’t have a date of entry won’t be accepted as a stand-alone identification document for dependents. The points were computed as a percentage of the principal amount of the mortgage. The funds you provided at or before closing, including any points the seller paid, were at least as much as the points charged. Payroll Payroll services and support to keep you compliant.

If you pay property taxes directly to your city, municipality, or county, providing a record of the payments you’ve made will suffice (they’re probably on your bank statements). Some local governments will include the previous year’s taxes on the property tax bill they send to each homeowner. If you’re still having trouble locating a record of the property taxes you paid, call or visit your county assessor’s office. Keeping full and accurate records is vital to properly report your income and expenses, to support your deductions and credits, and to know the basis or adjusted basis of your home. These records include your purchase contract and settlement papers if you bought the property, or other objective evidence if you acquired it by gift, inheritance, or similar means.

Private Mortgage Insurance Deduction

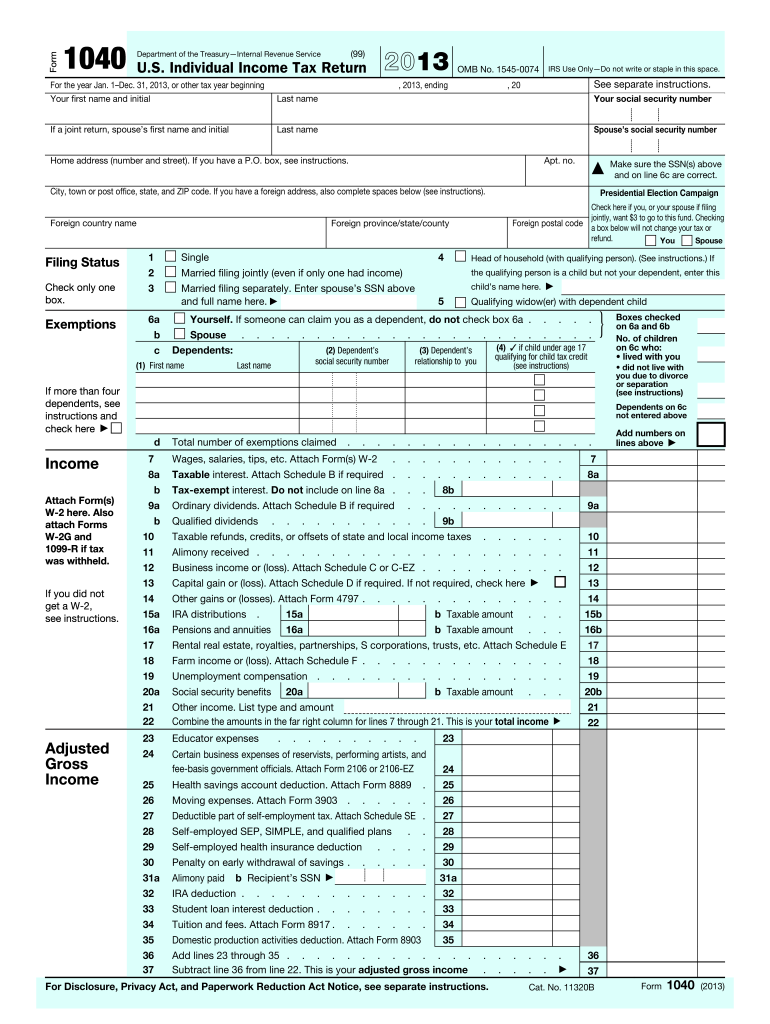

In the first few years of your mortgage you’re charged more for interest payments in the first few than you are for your last. This is because of amortization, the process lenders use to ensure the full loan balance is paid off by the end of the loan. So, if you have a 30-year mortgage, you’ll be paying a lot less in interest at year 25 than at year 5. This is good to know because if you’re going to claim the mortgage interest tax deduction, you’ll save more if you start claiming it in the beginning of your mortgage. If you took out a mortgage to finance the purchase of your home, you probably have to make monthly house payments.

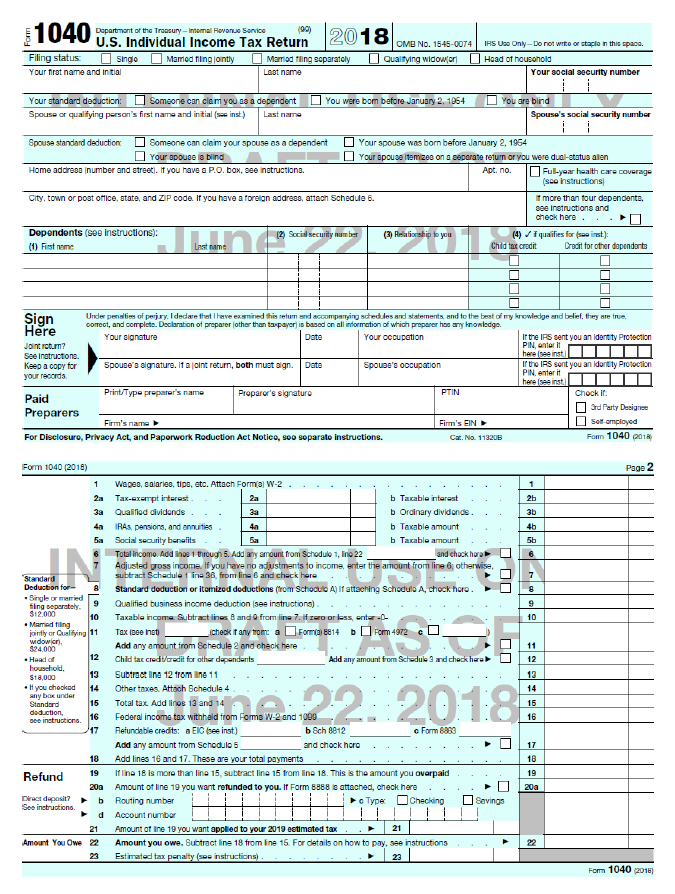

For filing a claim for credit or refund, this is generally 3 years from the date you filed the original return, or 2 years from the date you paid the tax, whichever is later. Returns filed before the due date are treated as filed on the due date. You can include in your basis the settlement fees and closing costs you paid for buying your home.

Mortgage credit certificate

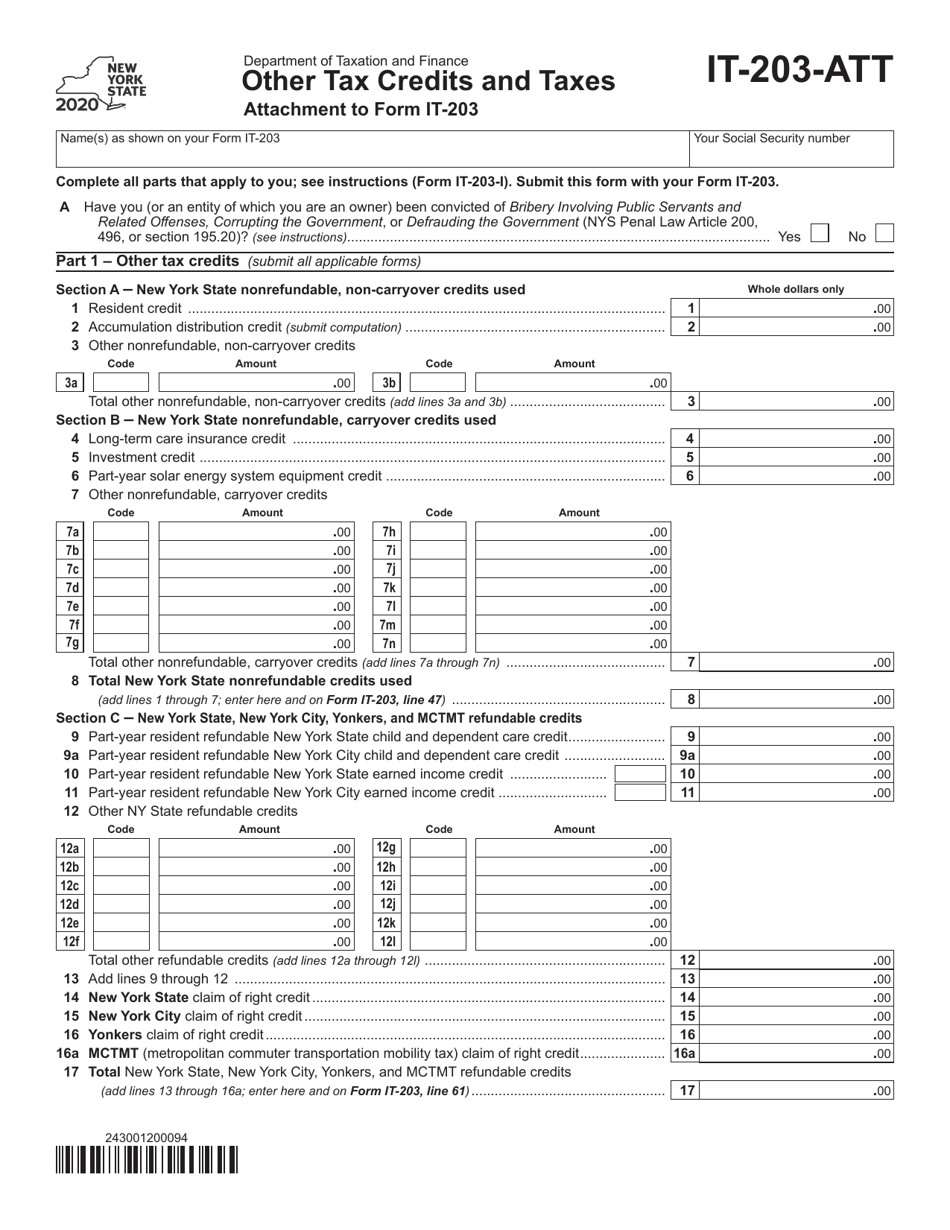

However, if either your old loan or your new loan has a variable interest rate, you will need to check this yourself. In that case, you will need to know the amount of the credit you could have claimed using the old MCC. An issuer may reissue an MCC after you refinance your mortgage. If you didn't get a new MCC, you may want to contact the state or local housing finance agency that issued your original MCC for information about whether you can get a reissued MCC. If you refinance your original mortgage loan on which you had been given an MCC, you must get a new MCC to be able to claim the credit on the new loan. The amount of credit you can claim on the new loan may change.

If an estate tax return was filed, your basis is generally the value of the home listed on the estate tax return. You owned the home in 2021 for 243 days , so you can take a tax deduction on your 2022 return of $946 [(243 ÷ 365) × $1,425] paid in 2022 for 2021. You add the remaining $479 ($1,425 − $946) of taxes paid in 2022 to the cost of your home. You receive a mortgage credit certificate from State X. This year, your regular tax liability is $1,100, you owe no alternative minimum tax, and your mortgage interest credit is $1,700. Your unused mortgage interest credit for this year is $600 ($1,700 − $1,100). You can carry forward this amount to the next 3 years or until used, whichever comes first.

Buying Your First Home

Mortgage Insurance PremiumsQualified Mortgage InsuranceAllocation of prepaid mortgage insurance premiums. Transferring funds from another bank account to your Emerald Card may not be available to all cardholders and other terms and conditions apply. There are limits on the total amount you can transfer and how often you can request transfers. Pathward does not charge a fee for this service; please see your bank for details on its fees.

If so, that amount will be shown on your settlement sheet. Include this amount in your real estate tax deduction. Note that you can't deduct the monthly payments into your escrow account as real estate taxes. Your deposits are simply money put aside to cover future tax payments. You can deduct only the actual real estate tax amounts paid out of the account during the year.

Let a tax expert do your taxes for you

The measure amends the IRS tax law to provide up to $15,000 in federal tax credits to first-time home purchasers. Taxpayers who sell their main home and have a gain from the sale may be able to exclude up to $250,000 of that gain from their income. Taxpayers who file a joint return with their spouse may be able to exclude up to $500,000. Homeowners excluding all the gain do not need to report the sale on their tax return. For tax purposes, a deductible is an expense that can be subtracted from adjusted gross income in order to reduce the total taxes owed. Be sure to include any interest that you paid as part of your closing.

Table 2 summarizes how to figure your credit if you refinance your original mortgage loan. If your allowable credit is reduced because of the limit based on your tax, you can carry forward the unused portion of the credit to the next 3 years or until used, whichever comes first. You must contact the appropriate government agency about getting an MCC before you get a mortgage and buy your home. Contact your state or local housing finance agency for information about the availability of MCCs in your area. A home includes a house, condominium, cooperative, mobile home, house trailer, boat, or similar property that has sleeping, cooking, and toilet facilities. If you meet all the tests under Exception, earlier, except that the points paid were more than are generally charged in your area , you can deduct in the year paid only the points that are generally charged.

Mortgage interest is one of the most common deductions that homeowners take advantage of. If you're taking out a mortgage to finance your home purchase, the interest that you pay on your loan is tax-deductible. In the following tax seasons, you will want to itemize your deductions on your tax return in order to deduct your mortgage interest. The total amount of interest you paid during the year will likely exceed the standard deduction amount. The standard deduction for married taxpayers who file joint returns is $25,900 for tax year 2022.

If you meet this criteria, the move must be due to a military order resulting in a permanent change of station. You can claim all of the unreimbursed expenses for yourself, your spouse, and your dependents. And it’s not just storage and traveling expenses to your new home that you can claim. You can also claim household goods, personal effects, and lodging expenses incurred as a result of your move. When you get your mortgage you have the option to pay a portion of your interest in advance to reduce your monthly mortgage payment.

For example, if you pay taxes at a 25 percent rate, your mortgage interest goes up by $3,500 and your property taxes go up by $1,100, you'll get $1,150 in tax savings. If you aren't already itemizing, you will have to compare the value of all the deductions you could itemize, including, but not limited to, your mortgage interest and property taxes. Generally, taxpayers must report forgiven or canceled debt as income on their tax return. This includes people who had a mortgage workout, foreclosure, or other canceled mortgage debt on their home. Homeowners cangenerally deduct home mortgage interest, home equity loan or home equity line of credit interest, mortgage points, private mortgage insurance , and state and local tax deductions.

Preparation costs for the mortgage note or deed of trust. You can use Figure A as a quick guide to see whether your points are fully deductible in the year paid. You can't deduct the full amount of points in the year paid. They are prepaid interest, so you must generally deduct them over the life of the mortgage.

Biden’s $15,000 First Time Homebuyer Tax Credit Proposal

So, if you claim a $1,000 deduction, you can expect your tax liability to drop by $240 ($1,000 × 24%). If you rented in the past, all of your money went to a landlord, and none of it came back to you as a tax deduction. If any of these situations apply, it is easy to take some deductions from the taxes that you have to pay. Given this, you will want to make sure that you are gaining the maximum amount of value that you can out of these cuts to your tax bill. Furthermore, the interest deduction is only available for the portion of your mortgage that is used to finance your new home purchase. This means that if you're using the proceeds from your old home sale to pay off debt or finance other expenses, you won't be able to deduct the interest on those debts.

What records you should keep as proof of the basis and adjusted basis. The credit for nonbusiness energy property has been extended through 2021. Certain tax benefits, including the following, that were set to expire have been extended.

No comments:

Post a Comment